Page 1

LILAC Document Help

BAS - GST

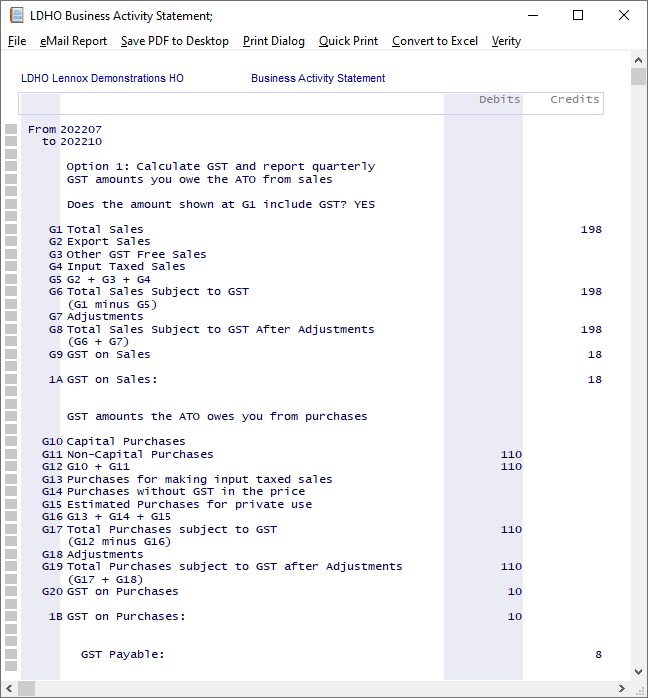

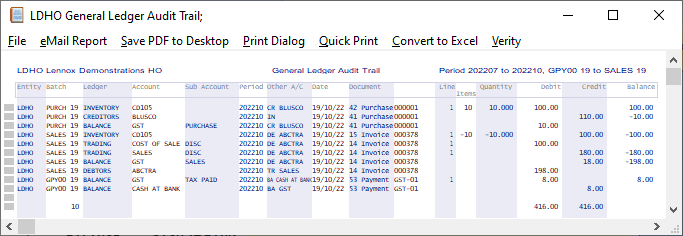

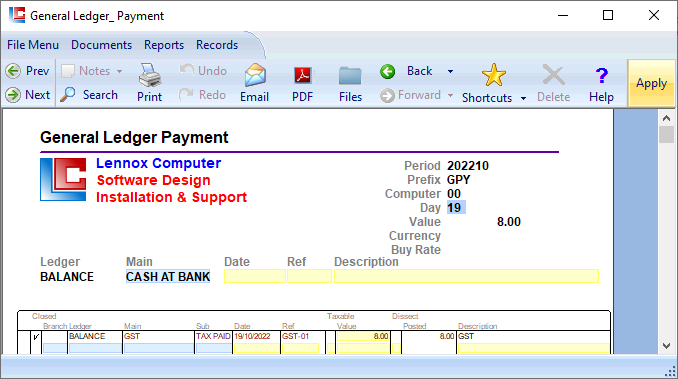

The following is an example of GST accruing in LILAC, and the subsequent CASH AT BANK posting in LILAC to reflect actual payment to the ATO.

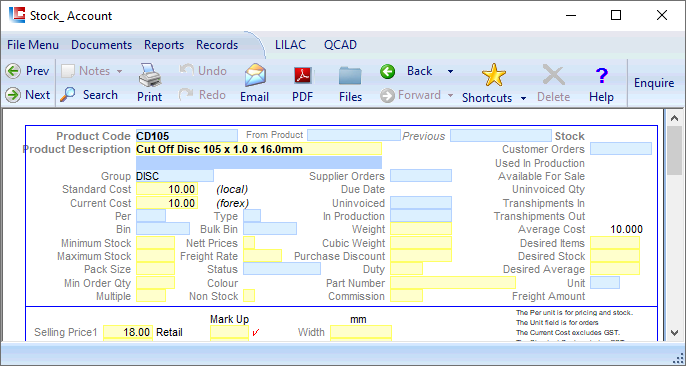

Stock Account of the product purchased and sold.

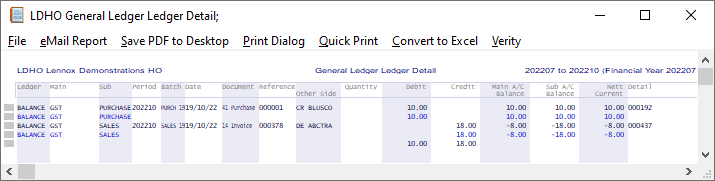

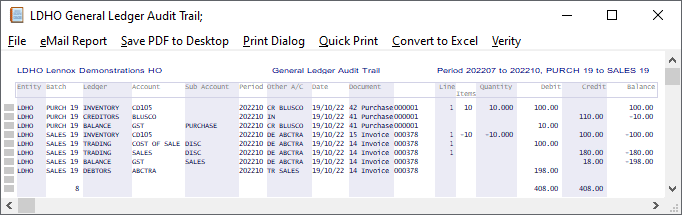

The Audit Trial displays the purchase and sale of the product CD105

Purchase Invoice 000001 debits: BALANCE : GST : PURCHASE for $10

Tax (Sales) Invoice 000378 credits: BALANCE : GST : SALES for $18

Purchase Invoice 000001 debits: BALANCE : GST : PURCHASE for $10

Tax (Sales) Invoice 000378 credits: BALANCE : GST : SALES for $18

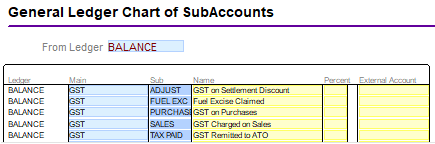

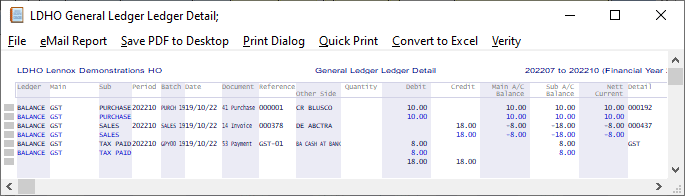

BALANCE : GST contains a number of Sub Accounts

BALANCE : GST : PURCHASES

BALANCE : GST : SALES

BALANCE : GST : TAX PAID -> Is used to clear the GST accruing (GST Sales minus GST Purchases) in LILAC

BALANCE : GST : PURCHASES

BALANCE : GST : SALES

BALANCE : GST : TAX PAID -> Is used to clear the GST accruing (GST Sales minus GST Purchases) in LILAC